Brokerage Will End Studies of Hospital Firm : Restructuring: Merrill Lynch analyst says Community Psychiatric Centers’ efforts to right itself are too little, too late.

- Share via

LAGUNA HILLS — Merrill Lynch will soon stop researching the performance of financially troubled Community Psychiatric Centers, complaining that the company’s restructuring effort is not proceeding fast enough.

Merrill Lynch analyst Larry Rader said in a telephone interview from his New York office that changes proposed by the Laguna Hills-based company to fill its growing number of empty beds amount to too little, too late.

The company’s decision in May to add “transitional care” wards to its hospitals had spurred discouraged analysts to hold out hope that CPC would soon regain profitability.

That, apparently, has not happened, at least not soon enough for Rader.

Merrill Lynch, Pierce, Fenner & Smith Inc. will stop reviewing the company on Sept. 11.

“It’s going to take longer to turn the ship around than I thought,” Rader said.

Rader, the latest analyst to offer a dimmed view of CPC, also said that he was immediately lowering his estimation of CPC’s value to investors.

Other brokerages, such as San Francisco’s Alex. Brown & Sons, have also ceased monitoring the performance of the company, once a highly regarded player in the psychiatric health care industry.

Company officials did not return phone calls for comment Wednesday.

CPC’s stock price has suffered in recent months from a general slump in the hospital industry, due partly to a trend against hospitalization, substituting outpatient treatment that is less expensive, and cutbacks in insurance coverage for such psychiatric care.

The company, which operates 50 hospitals throughout the United States, Puerto Rico and the United Kingdom, has seen its bed occupancy rate fall to 40% from 50% three years ago. Orange County facilities are located in Laguna Hills and Santa Ana.

As a result of the falling occupancy rate, CPC’s profits and stock value have plummeted in recent months.

In April, 1991, CPC stock was trading at about $40, but it has continued to erode--losing 75% of that value.

And profits have also diminished in the last year. Second-quarter earnings of $12.9 million, released in July, sank 52% from the previous second-quarter results.

To stem the downward slide, CPC said it would move toward the transitional care business in an effort to fill beds. Transitional care is a relatively new concept that fills a niche between general hospitals and nursing homes.

Patients either recovering from surgery or who do not need the intensive--and expensive--medical services of a hospital care could be placed in a transitional care ward.

Rader said the psychiatric care provider “has experienced some progress” in improving admissions during the current quarter and has $81.5 million in cash and a low ratio of long-term debt.

But, he added, per-patient revenue continues to sag and he anticipates a slowdown of growth for the next five-year period.

CPC closed Wednesday at $10.63 in New York Stock Exchange trading, unchanged from Tuesday.

Community Psychiatric in Ill Health

Since going public in 1969, Community Psychiatric Centers has had a meteoric rise in sales and earnings. But the Laguna Hills-based company has had a tough time coping with the current recession. Its earnings and stock price have taken such a beating that some analysts have announced that they will no longer track the company. Revenue In millions of dollars 1987: 218.7 1988: 273.3 1989: 330.7 1990: 381.8 1991: 396.6 1992*: 390.0 1993*: 340.0 * Analyst’s estimate. *

Profits In millions of dollars 1987: 48.3 1988: 58.5 1989: 72.0 1990: 83.2 1991: 45.3 *

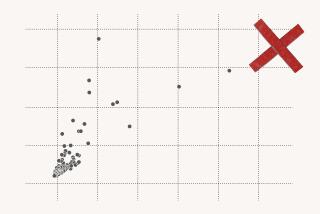

A Long Way to Fall

After hitting its third highest stock price last year, Community Psychiatric shares traded for $10.63 Wednesday, a nearly 75% decline in 16 months. *

Jan. 1991: $31.88 Feb.: 34.88 Mar.: 38.75 Apr.: 40.00 May : 36.00 June: 35.00 July: 30.88 Aug.: 31.38 Sept.: 28.63 Oct.: 17.88 Nov.: 14.00 Dec.: 14.13 Jan. 1992: 15.63 Feb.: 15.63 Mar.: 13.88 Apr.: 13.13 May: 12.63 June: 11.75 July: 12.38 Wednesday’s close: 10.63 Source: Community Psychiatric Centers, Dow Jones Retrieval Service

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.